Why Fintech?

“Access to affordable financial services is critical for poverty reduction and economic growth.”-Ceyla Pazarbasioglu, 2020

FinTech is revolutionizing the financial industry by introducing innovative, technology-driven solutions. These advancements are transforming everyday activities such as making payments (e.g., Square), transferring money (e.g., Venmo), and investing (e.g., Robinhood). By streamlining financial transactions and lowering costs, FinTech makes financial services more accessible and convenient for everyone.

The industry has experienced remarkable growth. In 2021, FinTech-related deals totaled $121.6 billion, representing a 153% year-over-year increase. Currently, there are more than 28,000 FinTech companies worldwide, with North America hosting 40% of them. This momentum shows no signs of slowing, with a projected 20% compound annual growth rate (CAGR) over the next four years, creating vast opportunities for innovation and entrepreneurship.

New Mexico Based Fintech

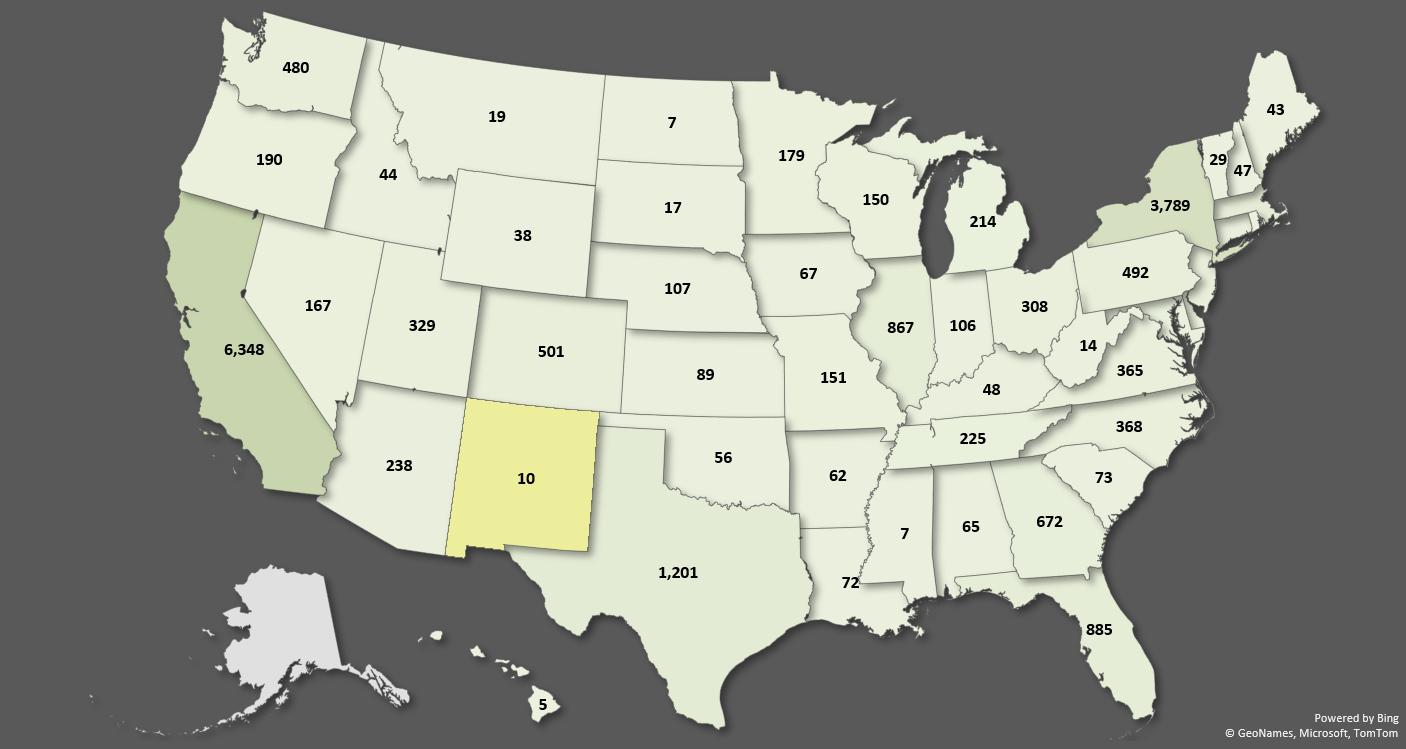

The answer is simple: why not New Mexico? The graphic below shows the total number of FinTech deals from 2000 to 2022; there have only been 10 deals in this state in more than 20 years. Currently, there are a total of 10 FinTech companies based in New Mexico, of which seven are generating revenue and three are in the start-up stage. This represents a big opportunity for local talent to disrupt the industry in our region.

Launching A Fintech Company

Launching a FinTech company might not be as expensive as it is for start-ups in other industries, given that these businesses are software-oriented. The FinTech Lab at Arrowhead Center offers valuable early stage resources to help start-ups reduce capital requirements while the foundation of their ventures mature.

The Lab looks forward to being the central point of financial technology innovations in the Southwest. Merging your ideas with the Fintech Lab resources is the first step towards the enhancement of social mobility and financial inclusion in our community.